sacramento property tax rate

To keep our example simple lets use a one percent property tax rate. Assessors Identification Number AIN A 10-digit number aka map book page and parcel that identifies each piece of real property for property tax purposes eg 1234-567-890.

Calculated Risk Worst Housing Affordability Since 1991 Excluding Bubble Real House Prices And Price To Rent Ra In 2022 House Prices Finance Blog Fixed Rate Mortgage

Our website has the complete.

. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Property inherited before Prop 19 took effect would have a 950 annual tax bill. If you would like to be notified when the next list will be available e-Subscribe for property tax sale notifications.

Average Effective Property Tax Rate. This particular tax also applies to a transfer of property to. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. If you need more information about California property tax visit us at. What is the Florida Property Tax Rate.

Sacramento Estate Planning Attorney. Property inherited after Prop 19 would have a 7k tax billa whooping 736 percent increase. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Supplemental Secured Property Tax Bill. Median home prices in Sacramento hover around 400k and the current median home price in San. If you would like a list to be mailed to you please send a check for 650 made out to the Sacramento County Tax Collector and mail to the Tax-Defaulted Land Unit 700 H Street Room 1710 Sacramento CA 95814.

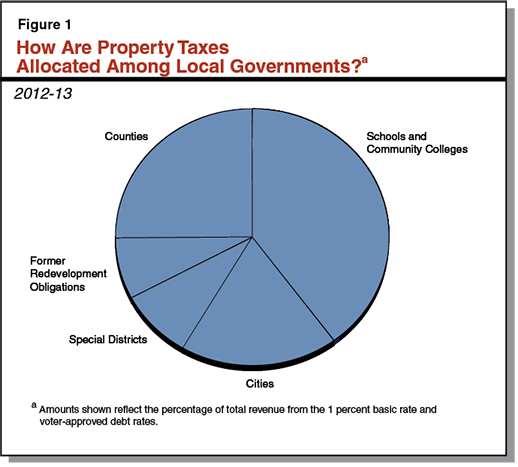

Or real estate assessments to 1975 market value levels limited the property tax rate to 1 percent plus the rate necessary to fund local voter-approved bonded indebtedness and limited future. Select the California city from the list of popular cities below to see its current sales tax rate. Taxpayers Rights Advocate Review You may contact the Taxpayers Rights Advocate if you have an ongoing state income tax problem that you have been unable to resolve through normal.

California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. The caveat here is the market value of the new house generally must be lower or equal to the home being sold. Our Mission - We provide equitable timely and accurate property tax assessments and information.

Similarly property with high basis can be allocated to a spouse that will be in a higher marginal bracket. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. Call 311 or go to wwwsac311.

The property tax rate in the county is 078. Secured property ownership secured and unsecured assessed valuation Assessors maps and other public information may be viewed using the self-service computers located at the Assessors Office 3636 American River Drive Suite 200 Sacramento CA 95864-5952 Monday through Friday 8 am. For example spouses and lineal heirs such as children are typically taxed at a lower rate.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. The City of Sacramento provides curbside collection of garbage yard waste and recycling for residential properties which include single family homes mixed use properties duplexes triplexes fourplexes and some larger multifamily dwellings. California has recent rate changes Thu Jul 01 2021.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. With local taxes the total sales tax rate is between 7250 and 10750. The rate of the tax that is imposed depends on the type of beneficiary you happen to be.

Learn more About Us. Where to find property taxes plus how to estimate property taxes. Here are the median property tax payments and average effective tax rate by Florida county.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Transfer California Property Tax for Homeowners 55 and over. Business Operation Tax.

If you do not have a property tax bill andor do not know your 14 digit PARCEL NUMBER you may obtain it by entering the address at the Assessors Office Parcel Viewer or by calling the Tax Collectors Office between 900 am. The ability to take advantage of Section 1041 allows taxpayers to shift property with significant amounts of built in gain to a spouse that will have a lower marginal tax rate after the divorce. Viewing Records at the Assessors Office.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Monday through Friday excluding.

E-PropTax is Sacramento Countys Online Property Tax Information. A spouse that will end up taking on. And has a reduced rate for extra recycle and yard waste containers.

The rate or value of a property for taxation purposes. Get FTB 4058 at ftbcagov or call us at 800-338-0505 select Personal Income Tax or mail us at Franchise Tax Board PO Box 942840 Sacramento CA 94240-0040.

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

July S Hottest Housing Markets Realtor Magazine Real Estate News Marketing Housing Market

Understanding California S Property Taxes

Property Tax Calculator Casaplorer

Business Property Tax In California What You Need To Know

Understanding California S Property Taxes

Alameda County Ca Property Tax Calculator Smartasset

Secured Property Taxes Treasurer Tax Collector

Property Tax Reductions To Diminish As Housing Market Improves

Understanding California S Property Taxes

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Secured Property Taxes Treasurer Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Business Property Tax In California What You Need To Know

It S Amazing To See Housing Inventory In The Sacramento Area Over The Past Decade Sacramento County County 10 Years

How To Calculate Property Tax Everything You Need To Know New Venture Escrow